Time to Sell Credit? Not So Fast.

- Jul 31, 2025

- 2 min read

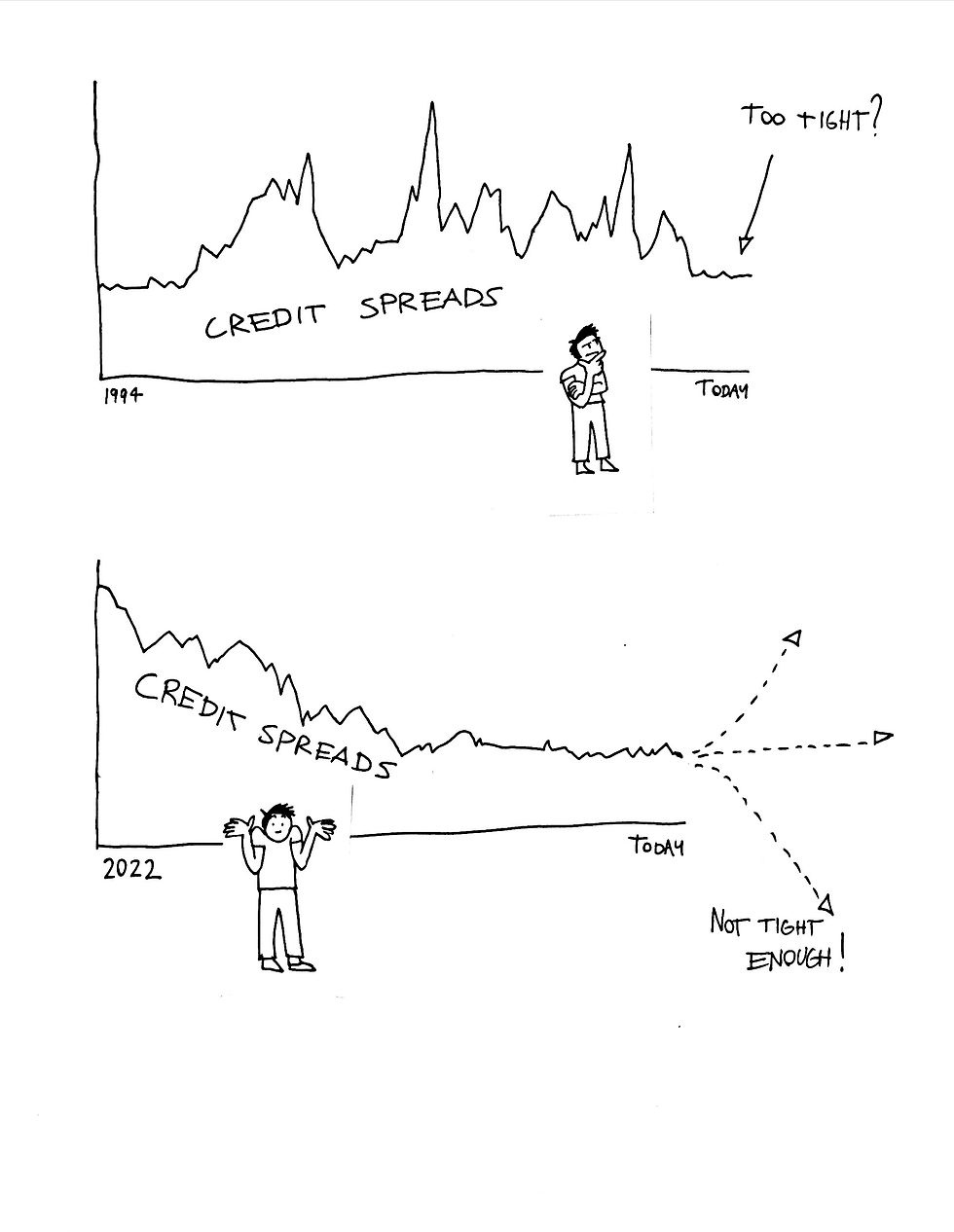

You'd need to go back to the mid-1990s to find richer credit markets.

Long credit spreads are 95 bps over treasuries, which means the market is willing to accept as little as 0.95% above treasuries for 30 years to compensate for credit risk and lower liquidity. The mean spread of long credit over the last 30 years is 160 bps.

That implies a loss of 8% in any swift, mean reversion. A Covid crisis style widening to 280 bps implies -23%!

So, sell credit? Not so fast. Remember, perspective matters.

Credit worthiness: Amid volatile policy, rudderless leadership, and ballooning deficits that have unmoored the dollar, high quality IG corporate debt is starting to look more creditworthy than the U.S. government. No surprise credit spreads are tightening...the real question is, why are they still so wide?

Volatility and liquidity: Gone are the days when treasuries traded like water and credit like molasses. Today, credit swaps, baskets, and ETFs often rival or surpass treasuries in day-to-day liquidity. Even in a crisis, treasuries are no sure bet. In March 2020 they traded as poorly as credit (off the run treasuries sported 20+ bp bid offer spreads) and in April of this year they showed no mettle as rates skyrocketed into the start of the tariff wars. Here's a stat: before 2022, long credit and long treasuries had similar monthly yield volatility (~90 bps). Post-2022, credit is at 58 bps vs 71 for treasuries.

Historical precedent: From 1994 to 1998, long credit spreads sat below 100 bps...at times as low as 60. We're only a few months into a similar stretch today. Some will point out that the '90s ended badly. They'll say AI is just another bubble, and equities are overvalued. I don't buy it. These comparisons overlook the fundamental strength of today's mega-cap, tech companies and the potential for a parabolic AI-driven productivity boom. AI actually argues for tighter spreads, for longer.

The AI productivity case: AI's productivity impact is obvious to anyone using it daily. I see it in my own work—from workflow management to coding to scenario analysis. Skepticism around monetization and hype is understandable but misses the point. AI is real and could be more transformative than the steam engine or internet.

The path forward is not smooth. Aside from social disruption, doomsday scenarios sit in the same room as the utopias envisioned by AI maximalists. Things could get weird and fast. Could we see AI accelerating growth to the point where the cost of holding uninvested capital drives "risk-free" rates dramatically higher, and the U.S., as a debtor nation, to the point of default?

Speculation aside, a productivity boom will benefit corporate America. High-grade corporate debt could trade through treasuries. Today, cash-rich mega-cap tech names (like Meta and Google) carry the same rating as the U.S. but trade 50+bps cheaper for long dated debt.

Tight? Historically, yes. But it might not be tight enough.

It's all about perspective.